A Guide to FIRPTA

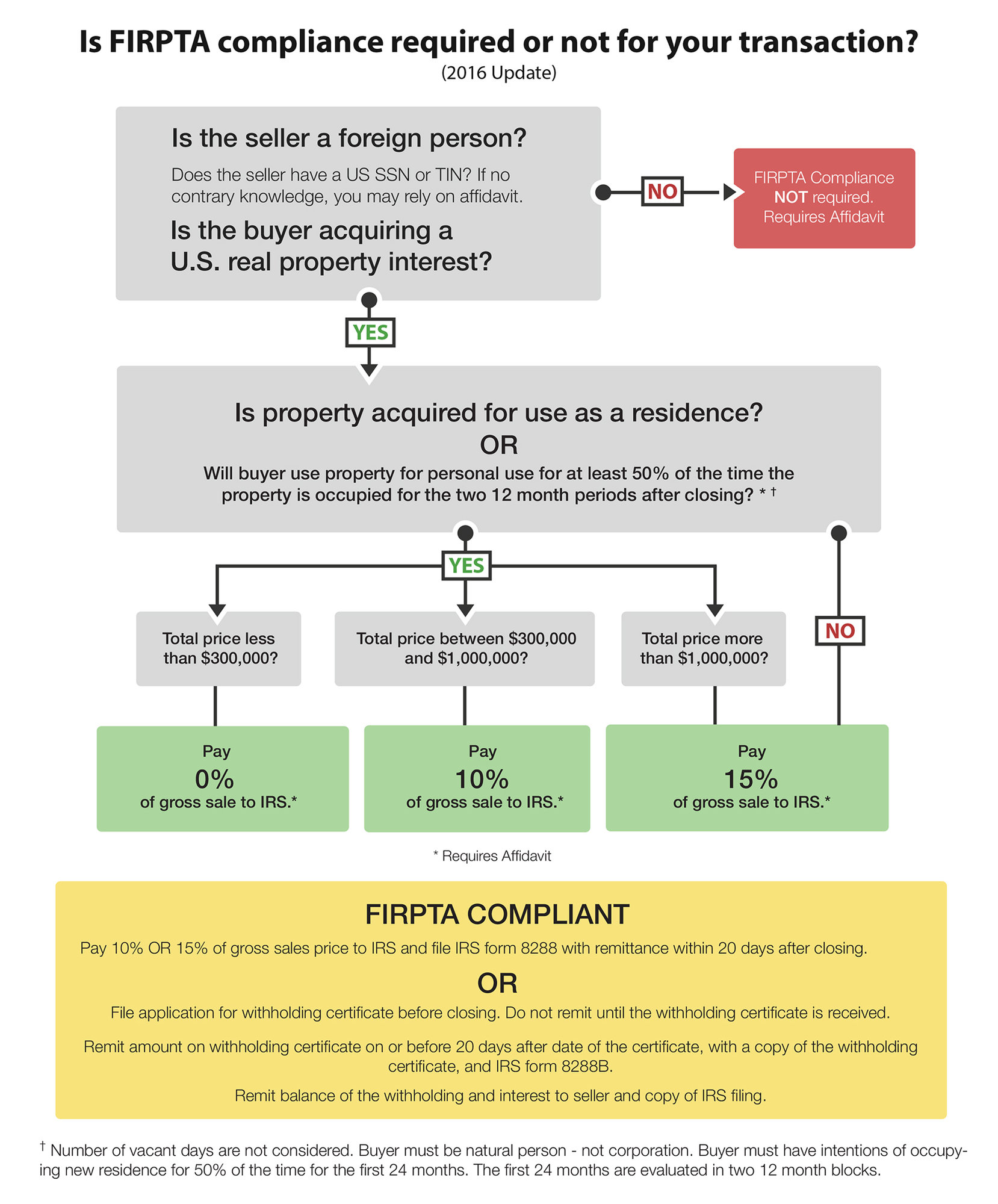

Below is a helpful chart to help you understand the Foreign Investment in Real Property Tax Act.

Key Take Away: In or to be exempt from FIRPTA Tax Withholdings, the Property Must sell for LESS than $300,000 ($299,999.99 or Less) and the property must be used for "personal use" more than 50% of the total occupied time. For example if the property is occupied for 3 days of the year, two of those days must be used for personal use and the other as a rental for instance. The time is based on "occupied time" not the total days of the year.

Hope this helps give you a better understanding of FIRPTA withholdings.

Even though, this information applies nation-wide, we specialize in helping clients here in our local areas of service: Naples, Fort Myers, Miami, Fort Lauderdale and the Florida Keys.

Questions?